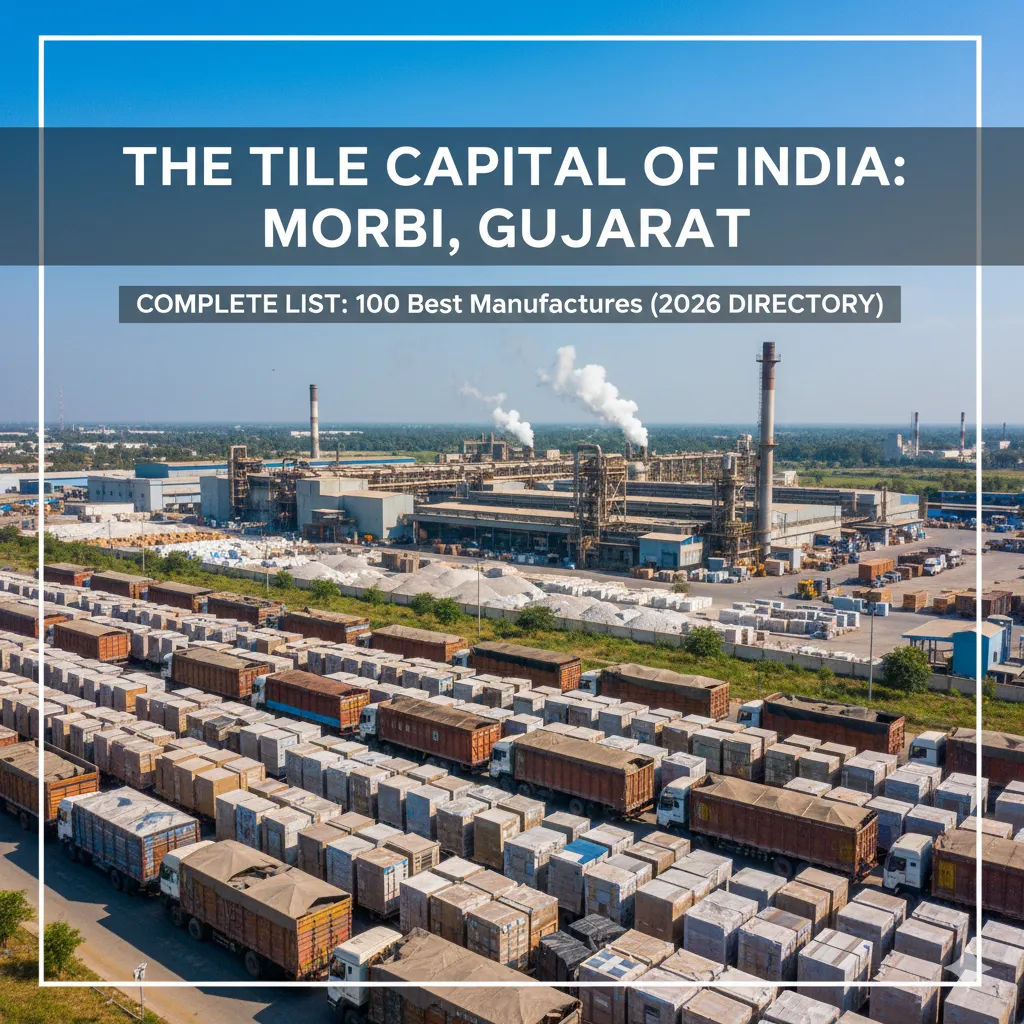

Introduction: Why Morbi is the Uncrowned Tiles Capital of the World

Best 100 tiles manufacturers India, Have you ever wondered where the tiles in your bathroom, kitchen, or office lobby actually come from? There’s a good chance they were manufactured in Morbi, a bustling district in Gujarat that’s quietly become the world’s second-largest ceramic tiles manufacturing hub. Sounds surprising? Let me give you the numbers: Morbi produces 4 million square meters of tiles daily – that’s enough to cover 560 football fields in just 24 hours. The city exports to 163 countries, generates ₹50,000 crore in annual turnover, and employs over 600,000 people directly and indirectly.

What’s truly mind-blowing is that this small town houses more than 800 ceramic manufacturing units crammed into a 40 km x 7 km area, producing a staggering 80% of India’s total ceramic tile output. This concentration of manufacturing might is unparalleled globally, rivaled only by Guangdong Province in China. But here’s what most people don’t realize: Morbi’s tiles aren’t just cheap alternatives – they’re world-class products competing with European and Italian tiles at nearly one-third the price. also you can check Top 10 Tiles Companies in India – The Ultimate Buyer’s Guide.

In this comprehensive guide, we’re breaking down the best 100 tiles manufacturers in India, focusing heavily on Morbi’s finest. Whether you’re a homeowner seeking quality tiles, a retailer looking to source products, a contractor needing bulk orders, or an international buyer exploring alternatives to Chinese imports, this guide will equip you with insider knowledge about Morbi’s manufacturing ecosystem. By the end, you’ll understand why global supply chains are shifting toward Morbi and which manufacturers deliver the best value for your specific needs.

COMPLETE LIST: 100 Best Tiles Manufacturers in Morbi, Gujarat, India (2026 Directory)

🏆 TOP 20 MEGA & LARGE MANUFACTURERS (10+ MSM Capacity)

- Kajaria Ceramics Ltd – 43.5 MSM/year

- RAK Ceramics India Pvt. Ltd – 118 MSM/year

- Simpolo Vitrified Ltd – 40 MSM/year

- Asian Granito India Ltd (AGL) – 54.5 MSM/year

- Somany Ceramics Ltd

- H&R Johnson (India) Ltd

- Orient Bell Ltd – 42.4 MSM/year

- Metro Group (Metrocity, Metropole, Metroworld)

- Nitco Ltd

- CERA Sanitaryware Ltd

- Varmora Granito Ltd

- Qutone Granito Pvt. Ltd

- Exxaro Tiles

- Solizo Vitrified Pvt. Ltd

- Italake Ceramic Pvt. Ltd

- Wolf Group India

- Grafite Ceramics Pvt. Ltd

- Millennium Tiles LLP

- Freedom Ceramic Pvt. Ltd

- Vivanta Ceramic

🏭 MID-SIZE MANUFACTURERS (1-5 MSM Capacity – #21-60)

- Antiek Vitrified LLP

- V Tiles Porselano

- Alaska Surfaces LLP

- Lavish Granito Pvt. Ltd

- Kripton Granito Pvt. Ltd

- Accord Vitrified Pvt. Ltd

- Clay Stone Granito Pvt. Ltd

- Lizzart Granito LLP

- Cruso Granito Pvt. Ltd

- Simonza Tiles LLP

- Skytouch Ceramic Pvt. Ltd

- Mozart Vitrified Pvt. Ltd

- Velloza Granito LLP

- Letina Ceramic

- Capron Vitrified Pvt. Ltd

- Lepono Porcelano LLP

- Spencera Ceramica LLP

- Adicon Ceramic LLP

- Greenzone Granito Pvt. Ltd

- Renite Vitrified LLP

- Segam Tiles Pvt. Ltd

- Sega Granito LLP

- Crevita Granito Pvt. Ltd

- Itoli Granito LLP

- Livenza Granito LLP

- Kamron Tiles LLP

- I Cera Tiles LLP

- Sentosa Granito Pvt. Ltd

- Ambani Vitrified Pvt. Ltd

- Siyaram Granito Pvt. Ltd

- Maps Granito Pvt. Ltd

- Simanto Vitrified LLP

- Sinox Granito

- Mega Tiles

- Rich Vitrified Pvt. Ltd

- Sez Vitrified Pvt. Ltd

- Mozilla Granito LLP

- Siscon Tiles LLP

- Mazzini Tiles LLP

- Titanium Vitrified Pvt. Ltd

⭐ EMERGING & SPECIALIZED MANUFACTURERS (#61-100)

- Fusion Granito Pvt. Ltd

- Lonix Ceramica

- Vento Ceramic

- Strawberry Ceramic Pvt. Ltd

- Astis Ceramic LLP

- Sunshine Tiles Co Pvt. Ltd (Sunheart)

- Sisam Ceramics Pvt. Ltd

- Elox Tiles

- Big Tiles

- Lemon Ceramic

- Scotto Tiles LLP

- Montello Ceramic LLP

- Rey Cera Creation Pvt. Ltd

- Vizoli Tiles LLP

- Captile Pvt. Ltd

- Itaca Ceramics Pvt. Ltd

- Lemosa Tiles LLP

- Cygen Ceramic LLP

- Eddica Ceramic LLP

- Recore Ceramic

- Hill Stone Ceramic Pvt. Ltd

- Lumen Ceramic Pvt. Ltd

- Nilkanth Glazed Pvt. Ltd

- Sunland Ceramic Pvt. Ltd

- Sanvis Ceramic Pvt. Ltd

- Liona Tiles LLP

- Captiva Ceramic Industries

- Evona Wall Tiles LLP

- Silventa Ceramic Tiles Pvt. Ltd

- Q-7 Ceramic LLP

- Orbit Cera Tiles Ltd

- Valencia Ceramic Pvt. Ltd

- Jubely Tiles LLP

- GemStone Ceramic LLP

- Avalta Granito

- Sakar Granito (India) Pvt. Ltd

- Cibela Vitrified Pvt. Ltd

- Simora Tiles LLP

- Kera Vitrified LLP

- Sparron Vitrified LLP

📊 Quick Reference by Category

| Category | Count | Capacity | Best For | Price Range |

|---|---|---|---|---|

| Mega/Large | 1-20 | 10-118 MSM/yr | Bulk projects | ₹30-80/sqft |

| Mid-Size | 21-60 | 1-5 MSM/yr | Custom orders | ₹40-100/sqft |

| Emerging | 61-100 | <1 MSM/yr | Premium designs | ₹80-200/sqft |

Section 1: Understanding Morbi’s Tiles Manufacturing Dominance

The Geographic & Strategic Advantage: Why Morbi Won

Location, location, location – it’s not just a real estate mantra; it’s the foundation of Morbi’s manufacturing supremacy. The city sits strategically within 180 kilometers of two major ports: Mundra and Kandla. This proximity transforms Morbi from a landlocked industrial zone into a global export powerhouse. For international buyers, this means faster shipping times, lower logistics costs, and easier coordination with customs.

But geography alone doesn’t explain Morbi’s dominance. The district is surrounded by rich deposits of essential raw materials – clay, feldspar, and silica – which are critical for tile manufacturing. Imagine building a car factory next to a steel mill; that’s the advantage Morbi possesses. Companies save on raw material transportation, reducing production costs by 15-25% compared to manufacturers located elsewhere.

Then came the infrastructure game-changer in 2007: the Gujarat government installed piped natural gas (PNG) supply to local industries through GSPC (Gujarat State Petroleum Corporation). Natural gas is the lifeblood of tile kilns, providing the intense heat required for ceramic firing. Before PNG, manufacturers depended on expensive diesel, making operations economically unviable at scale. The PNG supply transformed Morbi’s economics overnight, allowing factories to reduce production costs dramatically and maintain consistent kiln temperatures essential for quality consistency.

The Patel Ecosystem: How Business Community Excellence Built an Industry

Here’s a sociological insight: approximately 99% of Morbi’s tile manufacturers belong to the Patel business community. This isn’t coincidental. The Patels brought entrepreneurial DNA, built-in supply chains, shared knowledge networks, and a culture of continuous improvement. When one manufacturer solved a technical problem, the knowledge rippled through the community. When one secured better raw material suppliers, others benefited from competitive pricing. This ecosystem creates what economists call “network effects” – the total becomes greater than the sum of parts.

This tight-knit business community explains why Morbi has evolved so rapidly. In the 1990s, there were barely 50 tile factories; today, there are 800+, with 20 new units starting annually on average. Each new entrant brings innovation, competition spurs quality improvements, and exports drive global standards adoption. This is Darwinian capitalism at its best.

From Domestic Powerhouse to Global Exporter: The Evolution Timeline

The journey of Morbi’s tiles industry mirrors India’s own economic transformation. In the 1980s and early 1990s, tiles were considered a luxury product, available only in high-end construction projects. By the early 2000s, urbanization accelerated, real estate boomed, and tiles became mainstream. Morbi manufacturers seized this opportunity, scaling production and investing in modern machinery.

The real inflection point came around 2010-2015 when manufacturers realized they could compete globally. Rather than just exporting bulk unbranded tiles, they started building their own brands, investing in design innovation, and adopting Italian digital printing technology. Today, companies like Kajaria, Somany, and RAK Ceramics are household names not just in India but internationally.

The COVID-19 pandemic initially shocked Morbi’s export-dependent industry, but it also accelerated digitalization and reorganization. Post-2021, exports have surged. In 2024 alone, ceramic tile exports jumped 39% year-over-year, with emerging markets in Israel, Mexico, Russia, and South Africa showing explosive growth of 128-146%.

Section 2: Categories of Morbi Manufacturers – Finding Your Perfect Fit

Before diving into the 100 manufacturers, understand that they fall into distinct categories based on production capacity, specialization, and market focus. This framework helps you identify which manufacturers align with your needs.

Category 1: Mega Manufacturers (10+ Million Sq. Meters Annual Capacity)

These are the titans of Morbi. Companies like Kajaria Ceramics (43.5 MSM/year), RAK Ceramics India (118 MSM/year), and Metro Group (14 MSM across four plants) have massive production capacity, cutting-edge automation, ISO certifications, and global distribution networks. They serve large-scale projects, retail chains, and international distributors.

Why choose mega manufacturers?

- Consistent quality and reliable supply

- Extensive product range (500+ designs)

- International certifications and warranties

- Competitive pricing due to economies of scale

- Strong after-sales support and service centers

Best for: Large residential projects, commercial developers, international buyers, retail chains.

Category 2: Large Manufacturers (5-10 MSM Capacity)

Companies like Somany Ceramics, H&R Johnson, Asian Granito India (54.5 MSM), and Nitco fall into this category. They operate multiple plants, maintain strong brand presence, and balance volume with quality.

Why choose large manufacturers?

- Strong brand reputation and market presence

- Quality comparable to mega manufacturers

- Flexible order volumes

- Growing export capabilities

- Modernized facilities with Italian machinery

Best for: Architects, builders, mid-sized projects, exporters.

Category 3: Mid-Size Manufacturers (1-5 MSM Capacity)

Companies like Simpolo Vitrified, Italake Ceramic, Wolf Group India, and Grafite Ceramics dominate this segment. These manufacturers balance affordability with quality, often offering specialized products and customization.

Why choose mid-size manufacturers?

- Competitive pricing without compromising quality

- Greater flexibility and customization options

- Faster response times

- Often pioneers in niche products (large-format tiles, digital innovations)

- Direct owner involvement in quality decisions

Best for: Boutique projects, custom designs, bulk buyers seeking competitive rates, OEM/private label opportunities.

Category 4: Niche & Emerging Manufacturers (<1 MSM Capacity)

These smaller units specialize in high-end designs, limited editions, or specific tile types. Examples include Velloza Granito, Montello Ceramic, Captiva Ceramic, and GemStone Ceramic.

Why choose niche manufacturers?

- Unique, exclusive designs unavailable elsewhere

- Superior craftsmanship and attention to detail

- Perfect for premium residential projects

- Often the source of trendsetting designs later copied by larger players

- Direct customization and personal service

Best for: Interior designers, ultra-premium projects, those seeking exclusive patterns.

Section 3: Top 20 Manufacturers in Morbi – Detailed Profiles

1. Kajaria Ceramics Ltd – The Market Leader

Capacity: 43.5 Million Sq. Meters/Year (across 8 plants)

Founded: 1988

Market Position: India’s #1 tiles manufacturer, 8th globally

Key Strength: Unmatched product range (2,100+ designs), integrated supply chain, retail presence in 2,000+ outlets

Kajaria is synonymous with quality in India. The company’s eight manufacturing plants across different locations ensure regional distribution efficiency. Their product portfolio spans glazed vitrified tiles, polished vitrified, ceramic wall tiles, digital tiles, and large-format porcelain. Kajaria doesn’t compete just on price; they dominate through design innovation and brand trust.

Why Choose Kajaria?

- Proven export track record to 30+ countries

- Comprehensive warranties

- Advanced digital printing technology

- Competitive pricing starting at ₹50/sq ft

2. RAK Ceramics India Pvt. Ltd – The Premium Specialist

Capacity: 118 Million Sq. Meters/Year (highest in Morbi)

Founded: Local operations started mid-2000s

Parent Company: RAK Ceramics (UAE), one of world’s largest

Key Strength: International standards, large-format tile innovation, premium positioning

RAK brings global expertise to Morbi. Being part of a UAE-based conglomerate gives RAK access to international design trends, quality standards, and export networks. They’re pioneers in large-format tiles and premium finishes.

Why Choose RAK?

- International quality certifications

- Cutting-edge design trends

- Premium product lines with attractive finishes

- Established export channels

3. Simpolo Vitrified Ltd – The Innovation Champion

Capacity: 40 Million Sq. Meters/Year

Founded: 1977

Key Strength: Anti-skid tiles, near-zero water absorption technology, design excellence

Global Reach: 45-country export network

Simpolo exemplifies how mid-sized manufacturers can compete with giants through specialization. Their focus on technical superiority (anti-skid properties, water absorption rates) and aesthetic design has earned them a loyal following among architects and premium homeowners.

Why Choose Simpolo?

- Superior technical specifications

- Innovative product categories

- Excellent design quality

- Strong export presence justifies import quality

4. Asian Granito India Ltd (AGL) – The Fast Grower

Capacity: 54.5 Million Sq. Meters/Year

Founded: 2000

Market Position: 4th largest in India (3-4% market share)

Key Strength: Large-format tiles, digital tiles, rapid capacity expansion

AGL proves you don’t need decades of history to become an industry leader. Founded in 2000, AGL has grown exponentially through aggressive investments in technology, modern machinery, and market understanding.

Why Choose AGL?

- Modern manufacturing facilities

- Large-format tile expertise

- Competitive pricing

- Rapidly expanding dealer network

5. Somany Ceramics Limited – The Heritage Player

Capacity: Significant multi-unit operations

Founded: 1969

Key Strength: 50+ year history, diversified product range (tiles, sanitaryware), global presence

Export Markets: Russia, Middle East, Africa, UK

Somany combines heritage with modernization. Their long operational history has built trust, while their continuous investments in technology keep them competitive.

Why Choose Somany?

- Heritage brand with proven reliability

- Diverse product ecosystem

- Accessible pricing

- Wide distribution network

6. Metro Group (Metrocity Tiles, Metropole Tiles, Metroworld Tiles)

Combined Capacity: 14 Million Sq. Meters/Year (4 plants)

Key Strength: Integrated ecosystem, automated facilities, diverse product range

Metro Group’s multi-unit structure allows specialization – different plants focus on different tile categories, optimizing production and quality.

Why Choose Metro Group?

- Specialized facilities for specific products

- Integrated ecosystem for consistency

- Competitive bulk pricing

- Strong local presence in Morbi

7. H&R Johnson (India) Limited – The Lifestyle Solution Provider

Founded: 1985

Parent: Prism Cement Limited

Key Strength: Integrated home solutions (tiles, kitchens, bathrooms, furniture)

H&R Johnson’s ecosystem approach means you can source tiles, bathroom fixtures, and kitchen components from one manufacturer, ensuring design coherence.

Why Choose H&R Johnson?

- One-stop solution provider

- Design consistency across products

- Strong corporate backing

- Comprehensive product warranties

8. Orient Bell Limited – The Value Champion

Founded: 1977

Capacity: 42.4 Million Sq. Meters/Year

Key Strength: Germ-free tiles technology, affordability without quality compromise

Plants: Sikandrabad (UP), Hoskote (Karnataka), Dora (Gujarat)

Orient Bell is the choice for budget-conscious buyers who refuse to compromise on quality. Their germ-free tiles technology is particularly valuable for health-conscious consumers.

Why Choose Orient Bell?

- Exceptional affordability

- Unique germ-free technology

- Reliable quality

- Strong warranty support

9. CERA Sanitaryware Ltd – The Diversified Expert

Founded: 1980

Headquarters: Ahmedabad, Gujarat

Key Strength: Integrated bathroom solutions (tiles, sanitaryware, faucets)

CERA’s strength lies in understanding complete bathroom ecosystems. Their tiles are optimized for coordination with CERA’s sanitaryware products.

Why Choose CERA?

- Complete bathroom design solutions

- Coordinated aesthetics

- Quality range from budget to premium

- Strong service network

10. Nitco Ltd – The Design Pioneer

Founded: 1953

Dealer Network: 1,100+ dealers across India

Key Strength: Innovative designs, marble and mosaic specialization, unique patterns

Nitco proves that heritage manufacturers can remain relevant through continuous design innovation. Their patterns are often trend-setters in the industry.

Why Choose Nitco?

- Unique, trendsetting designs

- Exceptional dealer network for accessibility

- Long operational history ensures reliability

- Competitive pricing (₹45-60/sq ft)

11-20. Additional Top Manufacturers

Varmora Granito Ltd (₹30-80/sq ft pricing range, natural stone finishes), Qutone Granito Pvt. Ltd (quality-conscious approach), Exxaro Tiles (digital slabs, ultra-thin tiles), Solizo Vitrified Private Limited (specialized exporter, custom solutions), Italake Ceramic (rising star, OEM support), Wolf Group India (service-focused), Grafite Ceramics (premium designer), Millennium Tiles LLP (mass market player), Freedom Ceramic Pvt. Ltd (size specialist), Vivanta Ceramic (contemporary brand)

Section 4: Complete Directory of 100+ Morbi Manufacturers

Beyond the top 20, Morbi’s ecosystem includes numerous quality manufacturers across various categories.

Partial Directory: 50+ Additional Quality Manufacturers

Antiek Vitrified LLP, V Tiles Porselano, Alaska Surfaces LLP, Lavish Granito Pvt. Ltd, Kripton Granito Pvt. Ltd, Accord Vitrified Pvt. Ltd, Clay Stone Granito Pvt. Ltd, Lizzart Granito LLP, Cruso Granito Pvt. Ltd, Simonza Tiles LLP, Skytouch Ceramic Pvt. Ltd, Mozart Vitrified Pvt. Ltd, Velloza Granito LLP, Letina Ceramic, Capron Vitrified Pvt. Ltd, Lepono Porcelano LLP, Spencera Ceramica LLP, Adicon Ceramic LLP, Greenzone Granito Pvt. Ltd, Renite Vitrified LLP, Segam Tiles Pvt. Ltd, Sega Granito LLP, Crevita Granito Pvt. Ltd, Itoli Granito LLP, Livenza Granito LLP, Kamron Tiles LLP, I Cera Tiles LLP, Sentosa Granito Pvt. Ltd, Ambani Vitrified Pvt. Ltd, Siyaram Granito Pvt. Ltd, Maps Granito Pvt. Ltd, Simanto Vitrified LLP, Sinox Granito, Mega Tiles, Rich Vitrified Pvt. Ltd, Sez Vitrified Pvt. Ltd, Mozilla Granito LLP, Siscon Tiles LLP, Mazzini Tiles LLP, Titanium Vitrified Pvt. Ltd, Fusion Granito Pvt. Ltd, Lonix Ceramica, Vento Ceramic, Strawberry Ceramic Pvt. Ltd, Astis Ceramic LLP, Sunshine Tiles Co Pvt. Ltd, Sisam Ceramics Pvt. Ltd, Elox Tiles, Big Tiles.

Emerging & Specialized: Lemon Ceramic, Scotto Tiles LLP, Montello Ceramic LLP, Rey Cera Creation Pvt. Ltd, Vizoli Tiles LLP, Captile Pvt. Ltd, Itaca Ceramics Pvt. Ltd, Lemosa Tiles LLP, Cygen Ceramic LLP, Eddica Ceramic LLP, Recore Ceramic, Hill Stone Ceramic Pvt. Ltd, Lumen Ceramic Pvt. Ltd, Nilkanth Glazed Pvt. Ltd, Sunland Ceramic Pvt. Ltd, Sanvis Ceramic Pvt. Ltd, Liona Tiles LLP, Captiva Ceramic Industries, Evona Wall Tiles LLP, Silventa Ceramic Tiles Pvt. Ltd, Q–7 Ceramic LLP, Orbit Cera Tiles Ltd, Valencia Ceramic Pvt. Ltd, Jubely Tiles LLP, GemStone Ceramic LLP, Avalta Granito, Sakar Granito, plus 50+ additional manufacturers.

Section 5: Morbi’s Product Categories Explained

Glazed Vitrified Tiles (GVT)

These tiles undergo high-temperature glazing, creating a glossy, glass-like finish. They’re durable, have low water absorption, and are perfect for kitchens and bathrooms. Pricing ranges from ₹30-80/sq ft depending on design complexity.

Best Manufacturers: Kajaria, Simpolo, Nitco, Italake, Freedom Ceramic

Polished Glazed Vitrified Tiles (PGVT)

PGVT is essentially GVT that’s been polished to an even higher shine. The polishing process creates a mirror-like finish and makes tiles appear more luxurious. Costs ₹40-100/sq ft.

Best Manufacturers: RAK Ceramics, Somany, Solizo Vitrified, Vivanta Ceramic

Double Charge Tiles

These tiles have two distinct layers – a base layer and a decorative top layer. The double charge enhances design depth and durability. Pricing: ₹50-120/sq ft.

Best Manufacturers: Asian Granito, Metro Group, Millennium Tiles

Full Body Vitrified Tiles

Color and design penetrate the entire tile thickness, not just the surface. This means if scratched, the tile’s appearance isn’t compromised. Costs ₹45-90/sq ft.

Best Manufacturers: Kajaria, Somany, H&R Johnson

Large Format Tiles

Tiles larger than 600x1200mm represent the modern trend in ceramic design. Sizes like 800x1600mm, 1000x1000mm, and even 1200x2400mm are becoming standard in premium projects.

Best Manufacturers: RAK Ceramics, Asian Granito, Kajaria, Simpolo

Digital Tiles

Using advanced digital printing technology, manufacturers can create virtually any design or pattern. Perfect for custom projects, these tiles cost ₹60-150/sq ft depending on design complexity.

Best Manufacturers: Kajaria, H&R Johnson, Solizo Vitrified, Exxaro

Specialty Tiles

Anti-skid, germ-free, nano-polished, soluble salt vitrified, and porcelain tiles serve specific functional needs.

Best Manufacturers: Simpolo (anti-skid), Orient Bell (germ-free), Vivanta (nano-polished)

Section 6: How to Choose the Right Morbi Manufacturer for Your Needs

Step 1: Assess Your Requirements Matrix

Ask yourself these critical questions:

- Budget: ₹20-40/sq ft (budget), ₹40-80/sq ft (mid-range), ₹80-150/sq ft (premium)?

- Quantity: Small (100-500 sq ft), medium (500-2,000 sq ft), large (2,000+ sq ft)?

- Customization: Stock designs acceptable or do you need custom patterns?

- Timeline: Rush order or standard lead time (3-4 weeks acceptable)?

- Certifications: International exports needed or domestic only?

Step 2: Identify Relevant Manufacturer Categories

Match your requirements to manufacturer categories (mega, large, mid-size, niche). A mega manufacturer might offer economies of scale but less flexibility. A niche player might offer customization but longer lead times.

Step 3: Evaluate Quality Standards

Check for ISO 9001, ISO 14001 certifications, ISI/EN standard compliance. Request technical specifications: water absorption rates (<0.5% for vitrified tiles), scratch resistance testing, load-bearing capacity.

Step 4: Verify Export Capabilities

If considering bulk international orders, confirm the manufacturer’s export experience, documentation handling, container optimization knowledge, and relationships with logistics partners.

Step 5: Negotiate Rates and Terms

Bulk orders (1,000+ sq ft) warrant 10-15% discounts. Confirm payment terms, delivery timelines, warranty coverage, and claim processes before committing.

Section 7: Market Trends & Future Outlook for Morbi Manufacturers

Trend 1: Export Market Expansion

The fastest-growing export markets in 2025 are Israel (+146%), Mexico (+128%), Russia (+128%), and South Africa (+123%). Morbi manufacturers are rapidly establishing distribution channels in these markets.

Trend 2: Large-Format Dominance

Large-format tiles (600x1200mm+) are becoming standard in luxury residential and commercial projects, representing 35%+ of premium segment sales. Manufacturers are investing heavily in machinery capable of producing these sizes with minimal defects.

Trend 3: Sustainability Focus

Eco-friendly tiles using recycled materials and energy-efficient kilns are gaining traction. Green building certifications and sustainable practices are increasingly required for international projects.

Trend 4: Digital Transformation

E-commerce platforms, digital catalogs, 3D visualization tools, and virtual showrooms are modernizing how buyers interact with manufacturers. Forward-thinking companies are investing in these technologies.

Trend 5: Infrastructure Development

The proposed Morbi Ceramic Park, expected by 2027, will consolidate 1,600 modern manufacturing units with shared utilities, reducing costs and improving efficiency.

Section 8: Advanced Tips for Smart Sourcing

Tip 1: Direct Factory Visits

If ordering bulk quantities (5,000+ sq ft), visit the manufacturer’s facility. Observe production processes, machinery condition, quality control measures, and worker safety standards. This visit often yields additional discounts and relationship advantages.

Tip 2: Request Sample Lots

Always request actual samples (not just showroom displays) to verify color consistency, gloss level, and finish quality. Check samples under different lighting conditions – showroom lights differ dramatically from natural light in homes.

Tip 3: Understand Lead Times

Standard lead times are 3-4 weeks. Rush orders (2 weeks or less) incur 15-25% premium charges. Plan accordingly to avoid costly expedited shipping.

Tip 4: Leverage Trade Agreements

If importing internationally, check if your country has trade agreements with India that reduce tariffs. For example, Chile benefits from the India-Chile PTA with 0% tariff on tiles.

Tip 5: Build Long-Term Relationships

Rather than shopping for the absolute lowest price on every order, establishing long-term relationships with 2-3 trusted manufacturers often yields better overall value through consistent pricing, priority production slots, and improved service.

Section 9: FAQs About Morbi’s Tiles Manufacturers

Q1: Is it safe to buy tiles directly from Morbi manufacturers instead of established brands?

A: Absolutely, provided you choose manufacturers with proper certifications. Many established brands you see in showrooms are actually manufactured in Morbi. Buying directly cuts out middlemen, potentially saving 20-30%. However, ensure you verify certifications, quality standards, and payment security.

Q2: What’s the minimum order quantity typically required?

A: Most manufacturers accept orders of 100+ sq ft, though discounts improve significantly above 500 sq ft. Large bulk orders (5,000+ sq ft) can negotiate custom prices and exclusive designs.

Q3: How long does shipping take from Morbi to other countries?

A: Typically, production takes 3-4 weeks, followed by 3-5 weeks ocean shipping to international destinations. Total: 6-9 weeks for international orders. Expedited options cost more but reduce timelines to 4-6 weeks.

Q4: Can I get custom-designed tiles manufactured in Morbi?

A: Yes. Many mid-size and specialized manufacturers offer custom design services, including bespoke patterns, logos, and finishes. Custom orders typically require minimum quantities (500-1,000 sq ft) and incur design setup fees.

Q5: What should I check in the manufacturing certificate to ensure authenticity?

A: Look for ISO 9001 (quality management), ISO 14001 (environmental management), ISI certification (Indian Standards), and EN certifications (European standards). Request lab test reports confirming water absorption rates, PEI scratch resistance ratings, and slip resistance coefficients.

Conclusion: Your Path to Perfect Tiles from Morbi’s 100+ Manufacturers

Morbi’s tiles manufacturing ecosystem offers something for every need, budget, and project type. Whether you’re searching for economy tiles at ₹20/sq ft or luxury designer tiles at ₹150+/sq ft, manufacturers in Morbi deliver quality that competes globally while offering prices 30% lower than Chinese alternatives.

The 100+ manufacturers we’ve profiled represent a range of capabilities. Mega manufacturers like Kajaria and RAK provide scale, consistency, and reliability. Mid-size players like Simpolo offer innovation and customization. Emerging manufacturers bring fresh designs and competitive pricing. Understanding which category matches your needs is the first step.

Here’s your action plan:

For Homeowners: Start with mega or large manufacturers (Kajaria, Somany, Orient Bell). You’ll find extensive product ranges, reliable quality, and easy warranty support through their retail networks.

For Architects: Work directly with mid-size or specialized manufacturers. You’ll access design capabilities, customization options, and direct relationships for better service.

For Retailers/Brands: Partner with export-oriented manufacturers offering OEM support. Solizo, Italake, and specialized players excel here.

For International Buyers: Choose manufacturers with proven export experience (RAK, Kajaria, Asian Granito, Simpolo). Verify documentation handling, certification compliance, and logistics coordination.

Remember, tiles are a 15-20 year investment in your spaces. The few hours invested in choosing the right manufacturer and building a relationship yield decades of satisfaction. Morbi’s manufacturers have earned their global reputation through quality, innovation, and customer commitment. Your perfect tiles are waiting – the question is which of the 100+ manufacturers will deliver them.

For comprehensive information on tile selection, comparisons, trends, and manufacturer reviews, visit tilesblog, your complete resource for tiles industry insights.

Checklist: Before Finalizing Your Order

✓ Identify your budget range and tile type requirements

✓ Shortlist 3-5 manufacturers matching your criteria

✓ Request samples and verify quality under various lighting

✓ Check certifications (ISO, ISI, EN standards)

✓ Clarify lead times, delivery methods, and warranties

✓ Request references from previous customers

✓ Negotiate pricing for bulk orders (1,000+ sq ft)

✓ Verify payment security and terms

✓ Confirm communication points and escalation contacts

✓ Get written quotes specifying product details, quantities, pricing, lead times

✓ Verify authenticity through hologram labels and manufacturer confirmation

✓ Establish warranty coverage scope and claim process

Quick Reference: Manufacturer Categories at a Glance

| Category | Capacity | Best For | Price Range | Customization |

| Mega (10+ MSM) | 40-118 MSM/year | Large projects, retail | ₹30-80/sq ft | Limited |

| Large (5-10 MSM) | 14-54 MSM/year | Architects, builders | ₹35-90/sq ft | Moderate |

| Mid-Size (1-5 MSM) | 1-5 MSM/year | Custom projects | ₹40-100/sq ft | High |

| Niche (<1 MSM) | <1 MSM/year | Premium, exclusive | ₹80-200/sq ft | Very High |